In starting an LLC in Rhode Island, it is crucial to understand the importance of an Employer Identification Number (EIN) and how it impacts your business operations. An EIN is a unique nine-digit number the Internal Revenue Service (IRS) assigns to businesses operating in the United States for identification purposes. This number is essential for running a business, such as filing taxes, opening bank accounts, and hiring employees.

This article will explore the complete guide to obtaining an EIN in Rhode Island and the responsibilities and requirements associated with having an EIN.

Webinarcare Editorial Team will help you understand the process of obtaining an EIN. You must be guided by all the factors gathered in this article.

On this page, you’ll learn about the following:

EIN Definition and Purpose

To form an LLC, an EIN is necessary for your business. An Employer Identification Number (EIN) is a federal tax identification number used by the Internal Revenue Service (IRS) to identify businesses in the United States. It is similar to a Social Security Number (SSN) for individuals but is specifically designed for businesses. The main purpose of an EIN is to help the IRS track and administer taxes for companies.

In Rhode Island, businesses are required to have an EIN if they meet any of the following criteria:

- Have employees

- Operate as a Partnership or Corporation in Rhode Island

- File tax returns for employment, excise, or Alcohol, Tobacco, and Firearms (ATF) taxes

- Withhold taxes on income, other than wages, paid to a non-resident alien

- Have a Keogh plan (a tax-deferred pension plan for self-employed individuals or unincorporated businesses)

- Are involved with trusts, estates, real estate mortgage investment conduits, non-profit organizations, farmers’ cooperatives, or plan administrators

Recommended: With LegalZoom’s EIN service, obtaining your business’s crucial tax ID becomes a breeze, saving you time and effort by handling the complexities so you can quickly set sail on your entrepreneurial voyage. We recommend –

– LegalZoom – $79 (Standard Fee)

How to Obtain an EIN in Rhode Island

Obtaining an EIN in Rhode Island is a straightforward process; several methods are available to apply for one. However, if you want to be at ease with the process you can hire an LLC Services in Rhode Island, with add-ons of obtaining an EIN.

Online Application Process

The easiest and fastest way to obtain an EIN is by applying online through the IRS website. The online application is available for businesses in Rhode Island and the rest of the United States.

To apply for an EIN online, follow these steps:

- Visit the IRS EIN Assistant webpage.

- Click “Apply Online Now” and follow the prompts to complete the application.

- Provide the necessary information, such as your legal name, trade name (if applicable), business address, and the responsible party’s Social Security Number or Individual Taxpayer Identification Number.

- Select the appropriate legal structure for your business (e.g., sole proprietorship, general partnership, corporation, etc.).

- Provide additional information as required, such as the number of employees, the reason for applying, and the primary business activity.

- Review and submit your application.

Upon successful completion of the application, you will receive your EIN immediately. Save or print a copy of the confirmation notice for your records.

Other Application Methods

If you prefer not to apply online or are unable to access the online application, you can also obtain an EIN through the following methods:

- Fax: Complete Form SS-4 (Application for Employer Identification Number) and fax it to the appropriate fax number listed on the IRS website. You should receive your EIN within four business days.

- Mail: Complete Form SS-4 and mail it to the appropriate address on the IRS website. The processing time for mailed applications is approximately four weeks.

- Telephone: International applicants can apply for an EIN by calling the IRS at 267-941-1099 (not a toll-free number) from 6:00 a.m. to 11:00 p.m. Eastern Time, Monday through Friday.

After you have your EIN number, you can benefit in several ways. It will give your Rhode Island LLC the final advantage necessary to operate fully without legal or judicial issues.

If you have a Resident Agent, he can file an EIN for your business. Also, if you are planning to file for an LLC in Rhode Island, your Resident Agent should file for the Articles of Organization in Rhode Island.

Uses of EIN in Rhode Island

An EIN must run a business in Rhode Island. Some of the primary uses for an EIN include:

Opening a Business Bank Account

Banks typically require an EIN to open a business bank account, which is essential for separating your personal and business finances. With a business bank account, you can accept payments, deposit funds, and manage your company’s finances more efficiently.

If you are planning a bank for your Rhode Island business, you can check out the Best Banks in Rhode Island, which offer the best combination of fees, services, and convenience for your business needs.

Filing State and Federal Taxes

Businesses in Rhode Island must file taxes with both the state and federal governments, and an EIN is necessary to report and pay these taxes. Your EIN is used on various tax forms, such as income tax returns, employment tax returns, and excise tax returns which you can pay in Rhode Island Division of Taxation.

Payroll and Employee Tax Reporting

If your business has employees, you will need an EIN to report wages and other compensation paid to your workers. Additionally, an EIN is required for withholding and remitting federal income and payroll taxes on your employees’ behalf.

If you hire an employee for your business, you must request that your employees complete the following forms:

- Employment Eligibility Form

- Federal Tax Withholding Form

- W-4 Form

- Workers Compensation Claim Form

- Disability Self-Identification Form

- U.S. Citizenship and Immigration Services Form

Applying for Business Licenses and Permits

An EIN is often required when applying for business licenses and permits in Rhode Island. These licenses and permits may be necessary for various aspects of your business operations, such as zoning approval, health permits, or sales tax registration.

In Rhode Island, business license fee costs around the range of $50 – $300. You can check out Rhode Island Business Licenses to learn more about licenses and permits.

Establishing Credit and Securing Loans

An EIN can help your business establish credit, as it serves as an identifier for your company in the eyes of financial institutions. Additionally, lenders may require an EIN when applying for business loans or lines of credit.

Responsibilities and Requirements for EIN Holders in Rhode Island

As an EIN holder in Rhode Island, you are responsible for several tasks related to maintaining and managing your EIN. Some of these responsibilities and requirements include:

Updating the IRS on Changes to Business Information

If your business undergoes significant changes, such as a change in address, legal structure, or a responsible party, you must inform the IRS by filing the appropriate forms. This ensures the IRS has accurate and up-to-date information about your business and can properly administer taxes.

You can go to the Update My Information website of the Internal Revenue Service.

Required Tax Filings and Payments

With an EIN, your business is responsible for filing various tax returns and making tax payments to federal and state governments. Be informed about the specific tax obligations for your business type and industry in Rhode Island.

To keep your business in good standing in Rhode Island, you must file an Annual Report with the Rhode Island Secretary of State. The annual report provides updated information about your LLC, such as changes in address, members, or Resident Agent.

Record-Keeping Requirements

Proper record-keeping is essential for businesses with an EIN, as it helps ensure accurate tax reporting and compliance with laws and regulations. Maintain records of your company’s income, expenses, and other financial transactions to facilitate accurate tax filing and minimize potential issues with the IRS.

Establish a reliable accounting system to track income, expenses, and tax obligations. You can manage your finances using spreadsheets, accounting software, or hiring a professional accountant.

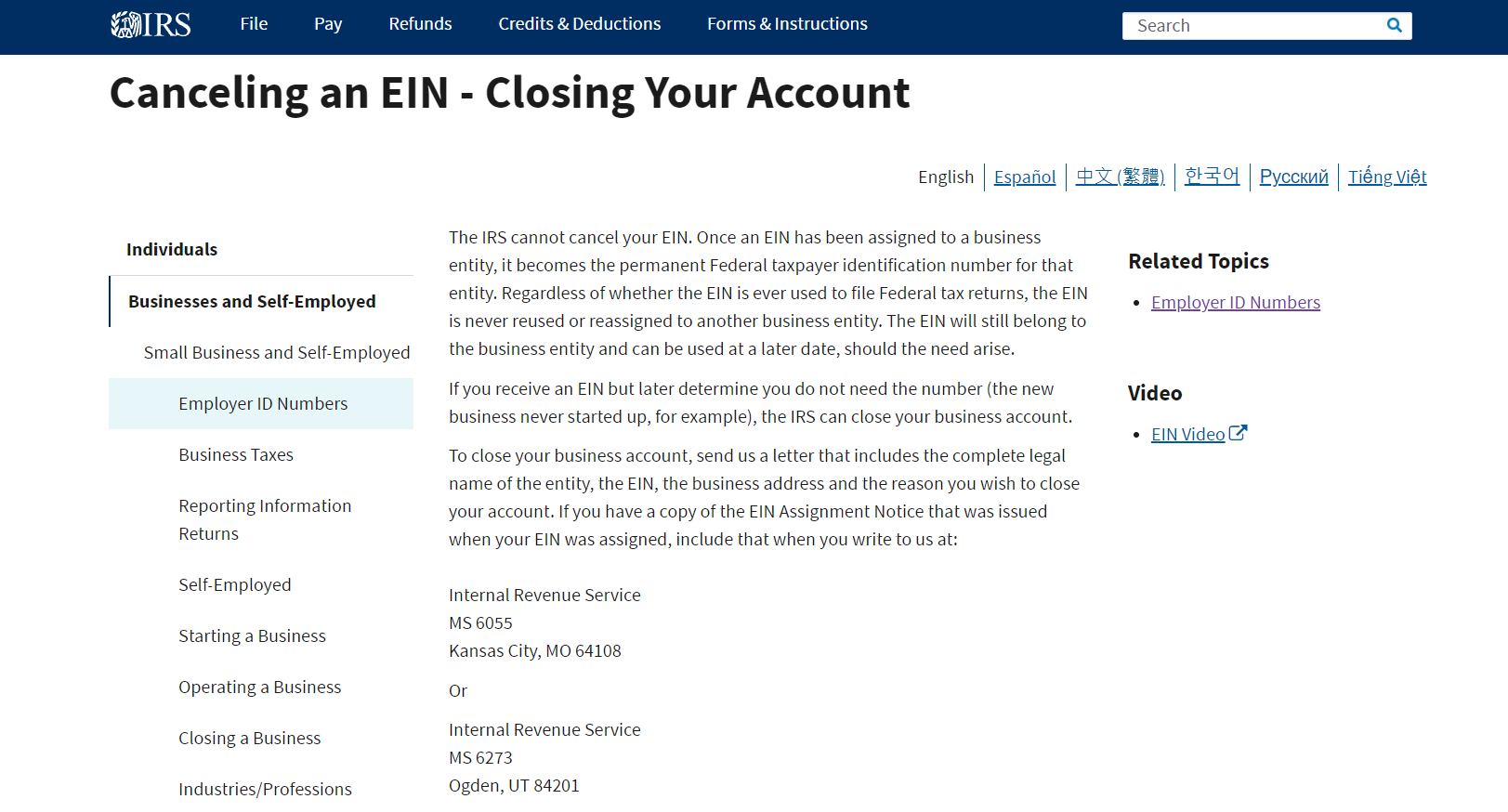

Closing an EIN Account

Suppose your business ceases operations or no longer requires an EIN. In that case, you must notify the IRS by submitting a letter containing your complete legal name, EIN, business address, and the reason for closing the account. This allows the IRS to update its records and prevent future tax-related issues.

If you have a copy of the EIN Assignment Notice that was issued when your EIN was assigned, include that when you write it to the IRS with the below mailing address:

- Internal Revenue Service MS 6055 Kansas City, MO 64108

- Internal Revenue Service MS 6273 Ogden, UT 84201

Or, you can check out Canceling an EIN via the IRS for further information.

Common Issues and Solutions for EIN in Rhode Island

Business owners in Rhode Island may encounter issues related to their EIN, such as losing or misplacing the number, incorrect information on the EIN application, or changes in business structure or ownership. Here are some solutions to common EIN-related problems:

- Lost or Misplaced EIN: If you lose or misplace your EIN, you can contact the IRS by calling their Business & Specialty Tax Line at 1-800-829-4933. The IRS representative can provide you with your EIN after verifying your identity.

- Incorrect Information on EIN Application: Suppose you discover an error on your EIN application, such as an incorrect business name or address. In that case, you can correct the information by submitting a letter to the IRS detailing the changes. Be sure to include your EIN, the incorrect information, and the correct information in your letter.

- Change in Business Structure or Ownership: If your business undergoes a significant legal structure or ownership change, you may need to obtain a new EIN. Consult the IRS guidelines to determine if a new EIN is necessary.

- Dealing with Identity Theft or Fraud: If you suspect your EIN has been compromised or used fraudulently, immediately report the issue to the IRS. The IRS can guide you through the steps to secure your EIN and protect your business from potential tax-related issues.

State-Specific EIN Information and Resources

To further assist businesses in Rhode Island, here are some state-specific resources and information related to EINs and taxation:

- State Tax Agency Information: The Rhode Island state tax agency can provide information on state tax requirements, forms, and filing deadlines. Be sure to familiarize yourself with the state tax obligations for your business type and industry.

- Business Registration Requirements: In addition to obtaining an EIN, businesses in Rhode Island must also register with the appropriate state agencies. This may include registering your business name, obtaining necessary licenses and permits, and registering for state taxes.

- Employer Tax Obligations and Filings: Employers in Rhode Island must comply with various state tax obligations, such as withholding state income tax from employee wages and reporting these withholdings to Rhode Island Division of Taxation. Research your business’s specific employer tax requirements in Rhode Island.

- Local Resources and Assistance for Businesses in Rhode Island: Many local organizations and government agencies in Rhode Island offer resources and assistance for small business owners. These resources may include business counseling, training, and financial assistance programs.

Do I Need to Apply for an EIN If I Also Have Business In Other States?

Yes, if you are operating a business with employees, have a corporation or partnership, or are required to file employment, excise, or alcohol, tobacco, and firearms tax returns, you will need an EIN (Employer Identification Number). If your business operates in multiple states, you only need one EIN for federal tax purposes. However, you may need to register for state-specific tax identification numbers in each state where you conduct business. Check with the Rhode Island Division of Taxation to determine their requirements.

FAQs

Also Read

- Obtain an EIN in Alabama

- Obtain an EIN in Alaska

- Obtain an EIN in Arizona

- Obtain an EIN in Arkansas

- Obtain an EIN in California

- Obtain an EIN in Colorado

- Obtain an EIN in Connecticut

- Obtain an EIN in DC

- Obtain an EIN in Delaware

- Obtain an EIN in Florida

- Obtain an EIN in Georgia

- Obtain an EIN in Hawaii

- Obtain an EIN in Idaho

- Obtain an EIN in Illinois

- Obtain an EIN in Indiana

- Obtain an EIN in Iowa

- Obtain an EIN in Kansas

- Obtain an EIN in Kentucky

- Obtain an EIN in Louisiana

- Obtain an EIN in Maine

- Obtain an EIN in Maryland

- Obtain an EIN in Massachusetts

- Obtain an EIN in Michigan

- Obtain an EIN in Minnesota

- Obtain an EIN in Mississippi

- Obtain an EIN in Missouri

- Obtain an EIN in Montana

- Obtain an EIN in Nebraska

- Obtain an EIN in Nevada

- Obtain an EIN in New Hampshire

- Obtain an EIN in New Jersey

- Obtain an EIN in New Mexico

- Obtain an EIN in New York

- Obtain an EIN in North Carolina

- Obtain an EIN in North Dakota

- Obtain an EIN in Ohio

- Obtain an EIN in Oklahoma

- Obtain an EIN in Oregon

- Obtain an EIN in Pennsylvania

- Obtain an EIN in Rhode Island

- Obtain an EIN in South Carolina

- Obtain an EIN in South Dakota

- Obtain an EIN in Tennessee

- Obtain an EIN in Texas

- Obtain an EIN in Utah

- Obtain an EIN in Vermont

- Obtain an EIN in Virginia

- Obtain an EIN in Washington

- Obtain an EIN in West Virginia

- Obtain an EIN in Wisconsin

- Obtain an EIN in Wyoming

How to Save Money While Getting Ein for Rhode Island LLC

One of the first ways to save money while getting an EIN for a Rhode Island LLC is by applying for the EIN online. The process of applying for an EIN online is simple and straightforward, and it can save time and money that would otherwise be spent on filing paperwork manually or hiring a service to do it for you. By applying online, you can avoid any unnecessary fees and ensure that the process is completed quickly and efficiently.

Another way to save money while obtaining an EIN for a Rhode Island LLC is by considering the option of hiring a registered agent. When starting a business, it is essential to have a registered agent who can receive legal notices and other important documents on behalf of the business. Hiring a registered agent can help in saving money in the long run, as it can prevent any costly legal issues from arising due to missed deadlines or overlooked documents.

Additionally, it is important to consider the various tax benefits and deductions available to Rhode Island LLCs. By understanding the tax laws and regulations that apply to your business, you can take advantage of any available tax breaks and deductions that can help save money in the long run. This can include deductions for business expenses, startup costs, and any other expenses related to running the business.

Furthermore, it is crucial to maintain accurate financial records for your Rhode Island LLC. By keeping track of all expenses and income related to the business, you can better understand where your money is going and identify areas where you can cut costs or save money. Additionally, accurate financial records are essential for tax purposes, as they can help in ensuring that you are not missing out on any potential tax savings or deductions.

In conclusion, saving money while getting an EIN for a Rhode Island LLC is essential for the long-term success and viability of the business. By following the tips outlined above, such as applying for the EIN online, hiring a registered agent, understanding tax benefits and deductions, and maintaining accurate financial records, you can effectively save money and maximize resources for your business. By being proactive and thoughtful about your financial decisions, you can set your Rhode Island LLC up for success and ensure that it thrives in the long run.

Conclusion

Understanding the importance and uses of an EIN in Rhode Island is crucial for the successful operation of your business. By obtaining and maintaining your EIN, you can ensure compliance with federal and state tax laws, establish a strong financial foundation for your company, and access various resources and opportunities for growth. Be sure to utilize the available resources and support for businesses in Rhode Island to maximize your chances of success.