The mortgage industry plays a crucial role in the economy as it facilitates the dream of homeownership of Massachusetts people. Forming a mortgage company can be a rewarding and profitable LLC in Massachusetts. However, it requires a deep understanding of the industry, regulatory requirements, and the necessary steps to establish and run a successful mortgage company. This comprehensive guide will walk you through Forming a Mortgage Company in Massachusetts and provide valuable insights to help you succeed in this competitive industry.

Webinarcare Editorial Team will help you gain knowledge through thorough research and market study. Before forming your Massachusetts mortgage company, all the steps in this article must guide you.

On this page, you’ll learn about the following:

- What is a Mortgage Company?

- How to Form a Mortgage Company in Massachusetts

- Step 1: Understanding the Mortgage Industry

- Step 2: Forming a Legal Entity

- Step 3: Developing a Business Plan

- Step 4: Register Your Mortgage Company

- Step 5: Obtaining Licenses and Registrations

- Step 6: Setting Up Your Office and Infrastructure

- Step 7: Hiring and Training Staff

- Step 8: Marketing and Growing The Company

- FAQs

What is a Mortgage Company?

In Massachusetts, a mortgage company is a business, often structured as a Limited Liability Company (LLC), that specializes in originating, funding, and servicing mortgage loans for homebuyers and property owners. These companies play a crucial role in the local housing market as they facilitate obtaining a mortgage loan for individuals looking to purchase, refinance, or invest in residential properties.

The Massachusetts Division of Banks regulates mortgage companies in Massachusetts and must obtain the appropriate licenses to operate legally. There are different types of mortgage companies, such as mortgage brokers, lenders, and loan originators, each with specific roles and responsibilities within the mortgage industry.

- Mortgage brokers act as intermediaries between borrowers and mortgage lenders, assisting homebuyers in finding the Best Massachusetts Small Business Loan product and terms to suit their needs.

- Mortgage lenders are financial institutions that provide the funds for mortgage loans directly or through a network of mortgage brokers.

- Mortgage loan originators are individuals employed by mortgage companies who work with borrowers to process and submit loan applications, negotiate loan terms, and complete the mortgage transaction.

Operating a mortgage company in Massachusetts requires a deep understanding of the local housing market, industry regulations, and the various mortgage products available to borrowers. By providing valuable services and expertise to homebuyers and property owners, mortgage companies in Massachusetts play a vital role in helping individuals achieve their homeownership dreams and supporting the state’s overall economy.

If you plan to start an LLC for your mortgage company, we provide the Best LLC Services to check out. This includes the top features and prices that will benefit your business.

How to Form a Mortgage Company in Massachusetts

Forming a mortgage company in Massachusetts can be complex, but the following step-by-step guide will help you navigate the requirements and regulations.

Step 1: Understanding the Mortgage Industry

The mortgage industry in Massachusetts is governed by various state and federal laws and regulations designed to protect consumers and ensure a fair and stable market—the primary regulatory authority for mortgage companies in Massachusetts Division of Banks. The Massachusetts Division of Banks is responsible for licensing and regulating mortgage companies and their activities within the state.

Before starting a mortgage company in Massachusetts, it is essential to understand the different types of mortgage licenses and activities regulated by the Massachusetts Division of Banks. These include:

| Mortgage Broker | A person or entity that, for compensation or gain, assists borrowers in obtaining mortgage loans from third-party lenders. |

| Mortgage Lender | A person or entity that originates, funds, or services mortgage loans. |

| Mortgage Loan Originator (MLO) | An individual who, for compensation or gain, takes mortgage loan applications or offers or negotiates terms of mortgage loans. |

It is suggested that you speak with a legal professional before you begin setting up a mortgage company. They’ll understand what’s best for you and your future company. To safeguard your personal assets from business debts, you can always start an LLC in Massachusetts.

– WEBINARCARE EDITORIAL TEAM

Step 2: Forming a Legal Entity

Once you clearly understand the mortgage industry and the specific license type you want to pursue in Massachusetts, the next step is to form a legal entity for your mortgage company. The most common types of legal entities for forming a mortgage company in Massachusetts include:

Sole Proprietorship

This is the simplest form of business entity, where an individual operates the Massachusetts mortgage company under their name or a trading name. There are no formal registration requirements, but the owner is responsible for all business debts and liabilities.

Partnership

A partnership is a business entity where two or more individuals come together to form a mortgage company. All partners are personally liable for the business’s debts and liabilities in a General Partnership. Limited Partnerships and Limited Liability Partnerships offer some protection for partners from personal liability.

Limited Liability Company (LLC)

An LLC is popular for forming a mortgage company, combining a corporation’s liability protection with a partnership’s tax flexibility. LLC owners, known as members, are not personally liable for the business’s debts and liabilities.

Corporation

A corporation is a legal entity separate from its owners, known as shareholders. Starting a corporation in Massachusetts provides liability protection for its owners and is subject to corporate taxation. Forming a corporation involves more administrative requirements and fees than other business structures. There are different types of corporations, such as S and C corporations, each with tax implications and requirements.

To form a mortgage company in Massachusetts, consult a Business Attorney in Massachusetts to understand the state’s requirements for forming a legal entity and obtaining necessary licenses and permits.

Step 3: Developing a Business Plan

A well-crafted business plan is essential for the success of your Massachusetts mortgage company. The business plan should outline your company’s mission, vision, objectives, target market, competitive analysis, marketing strategy, financial projections, and management structure.

Your business plan will serve as a roadmap for your company’s growth and help you secure financing or investment to start and grow your business.

Step 4: Register Your Mortgage Company

You must register your Massachusetts mortgage company. Here are the guidelines you must accomplish before obtaining the licenses and permits.

Choose a Business Name

Choosing a business name for your Massachusetts mortgage company involves several steps. Here are some guidelines to help you choose an effective name:

- Your business name should reflect the brand identity you want to convey to your potential clients. Consider your target audience, your company’s values, and the services you offer when choosing a name.

- Including words related to the mortgage industry in your business name can help potential clients understand the nature of your business. Some keywords to consider are “mortgage,” “loan,” “home,” “finance,” or “lending.”

- Including the name of Massachusetts in your business name can help establish a sense of familiarity and trust with potential clients from the same state. For example, “Massachusetts Mortgage Solutions” or “Massachusetts Home Loan Experts.”

- A shorter, easy-to-remember name can make it easier for potential clients to recall your business when they need mortgage services.

Remember to check the availability of your chosen business name with the Massachusetts Secretary of the Commonwealth Corporations Division to ensure that no one else has trademarked the name. There is a complete guide on Massachusetts Business Name Search for you to have a mortgage company name. You can register your business under a different legal name if your preferred name isn’t available. Once you have chosen a name, you can submit an application for Massachusetts DBA (doing business as).

Once you’ve settled on a unique name, you can proceed with choosing a Resident Agent down to obtaining any required licenses and permits.

Recommended: Embark on your entrepreneurial journey confidently and affordably with LegalZoom’s DBA service, the beacon that guides businesses to credible branding and comprehensive compliance. Discover how effortless success can truly be!

– LegalZoom – ($99 + Filling Fees)

Choose a Resident Agent

A Resident Agent is a person or entity designated to receive important legal documents and correspondence for your business. In Massachusetts, every business entity, such as an LLC or a corporation, must have a Resident Agent with a physical address within Massachusetts. The Resident Agent’s primary role is to ensure that your business complies with state regulations and be available to receive any legal notices or official government correspondence.

In Massachusetts, the cost of having a Resident Agent ranges from $50 – $200. However, suppose you are still wondering how to hire a Resident Agent. You can also serve as your Resident Agent, appoint a friend or family member, or hire a professional Massachusetts Resident Agent Services.

Recommended: Professional services will ensure your business gets legal notices and critical mail. With LegalZoom’s Registered Agent Services, they offer peace of mind and expert support for businesses, ensuring compliance and seamless communication with state authorities. That’s why we recommend using –

LegalZoom – $249/year

File for Certificate of Organization or Articles of Incorporation

If you form an LLC for your Massachusetts mortgage company, you must file the Massachusetts Certificate of Organization, which costs $500. However, you must file the Articles of Incorporation if you form a Corporation for your Massachusetts mortgage company.

Including accurate and comprehensive information on this page is essential since mistakes or inconsistencies may delay or dismiss your filing.

Recommended: Filing the Certificate of Organization and the Articles of Incorporation is easy and hassle-free if you hire a professional service. We recommend using –

LegalZoom – ($0 + State Fee)

Obtain an Employer Identification Number

You must first obtain an Employer identification number (EIN) in Massachusetts if you will open a bank account or hire an employee for your Massachusetts mortgage company.

The application of an EIN in Massachusetts can be through the following:

- Apply Online- The online EIN application is the preferred method for customers to apply for and obtain an EIN.

- Apply by Fax- Taxpayers can fax the completed Form SS-4 application to the appropriate fax number), after ensuring that the Form SS-4 contains all of the required information.

- Apply by Mail- The EIN application Form SS-4 can be filed via mail. The processing time frame to receive the mail is four weeks.

- Apply by Telephone (International Applicants) – International applicants may call 267-941-1099 (not a toll-free number) from 6 a.m. to 11 p.m. (Eastern Time) Monday through Friday to obtain their EIN.

Recommended: Professional services have the EIN included in their LLC formation package. We recommend using –

LegalZoom – ($0 + State Fee for LLC formation)

Step 5: Obtaining Licenses and Registrations

You must obtain a license from the Massachusetts Division of Banks to operate a mortgage company in Massachusetts. The licensing requirements vary depending on the mortgage activity you plan to engage in (e.g., mortgage broker, mortgage lender, or mortgage loan originator).

Here are the general steps to obtain a mortgage license in Massachusetts:

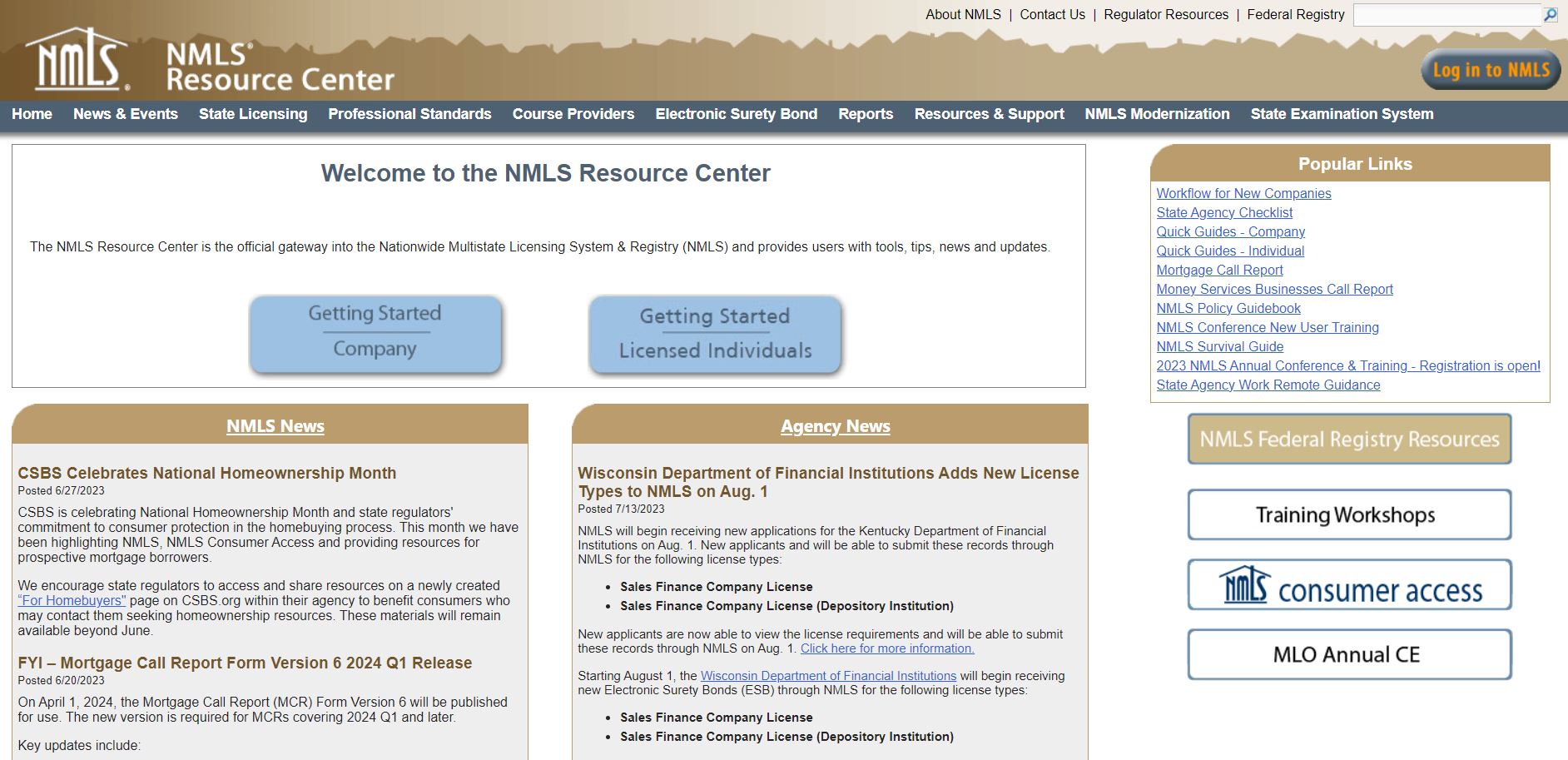

- Complete a license application through the Nationwide Mortgage Licensing System (NMLS). The NMLS is a web-based system that allows mortgage companies and MLOs to apply for, update, and renew their licenses online.

- Complete pre-licensing education and pass the NMLS national and state-specific mortgage exams.

- Submit fingerprints for a criminal background check and authorize a credit report through the NMLS.

- Obtain a surety bond in an amount specified by the Massachusetts Division of Banks. The bond amount will depend on the type of mortgage license you are applying for and the volume of your mortgage loan activity.

- Provide proof of financial responsibility, such as a minimum net worth or a fidelity bond, as required by the Massachusetts Division of Banks.

- Pay the applicable licensing and application fee of $1,500.

In addition to the mortgage license, you may also need to obtain other licenses, permits, or registrations, depending on your business activities and local requirements. The business license fee in Massachusetts ranges from $50 – $300.

Step 6: Setting Up Your Office and Infrastructure

A professional and well-equipped office is essential for the smooth operation of your Massachusetts mortgage company. Choose a suitable location for your office, considering accessibility, visibility, and proximity to your target market. Ensure your office complies with the Americans with Disabilities Act (ADA) and other local building codes and regulations.

Step 7: Hiring and Training Staff

Your Massachusetts mortgage company’s success will largely depend on your team’s quality and expertise. Hire qualified and experienced professionals, such as mortgage loan originators, processors, underwriters, and administrative staff. However, ensure that your team members meet the necessary licensing and education requirements before hiring an employee for your Massachusetts mortgage company.

Step 8: Marketing and Growing The Company

A well-thought-out marketing strategy is crucial for attracting clients and growing your mortgage company. Some effective marketing tactics for your mortgage company include:

- Build a professional website showcasing your services, expertise, and testimonials from satisfied clients.

- Leverage social media platforms to create brand awareness and engage your target audience.

- Networking with real estate agents, builders, and other industry professionals to build referral partnerships.

- Participating in local community events and sponsoring charitable causes to create a positive brand image.

- Offering educational content, such as blog articles, webinars, and seminars, to provide value to your clients and establish yourself as an expert in the mortgage industry.

FAQs

Also Read

- Form a Mortgage Company in Alabama

- Form a Mortgage Company in Alaska

- Form a Mortgage Company in Arizona

- Form a Mortgage Company in Arkansas

- Form a Mortgage Company in California

- Form a Mortgage Company in Colorado

- Form a Mortgage Company in Connecticut

- Form a Mortgage Company in DC

- Form a Mortgage Company in Delaware

- Form a Mortgage Company in Florida

- Form a Mortgage Company in Georgia

- Form a Mortgage Company in Hawaii

- Form a Mortgage Company in Idaho

- Form a Mortgage Company in Illinois

- Form a Mortgage Company in Indiana

- Form a Mortgage Company in Iowa

- Form a Mortgage Company in Kansas

- Form a Mortgage Company in Kentucky

- Form a Mortgage Company in Louisiana

- Form a Mortgage Company in Maine

- Form a Mortgage Company in Maryland

- Form a Mortgage Company in Massachusetts

- Form a Mortgage Company in Michigan

- Form a Mortgage Company in Minnesota

- Form a Mortgage Company in Mississippi

- Form a Mortgage Company in Missouri

- Form a Mortgage Company in Montana

- Form a Mortgage Company in Nebraska

- Form a Mortgage Company in Nevada

- Form a Mortgage Company in New Hampshire

- Form a Mortgage Company in New Jersey

- Form a Mortgage Company in New Mexico

- Form a Mortgage Company in New York

- Form a Mortgage Company in North Carolina

- Form a Mortgage Company in North Dakota

- Form a Mortgage Company in Ohio

- Form a Mortgage Company in Oklahoma

- Form a Mortgage Company in Oregon

- Form a Mortgage Company in Pennsylvania

- Form a Mortgage Company in Rhode Island

- Form a Mortgage Company in South Carolina

- Form a Mortgage Company in South Dakota

- Form a Mortgage Company in Tennessee

- Form a Mortgage Company in Texas

- Form a Mortgage Company in Utah

- Form a Mortgage Company in Vermont

- Form a Mortgage Company in Virginia

- Form a Mortgage Company in Washington

- Form a Mortgage Company in West Virginia

- Form a Mortgage Company in Wisconsin

- Form a Mortgage Company in Wyoming

Conclusion

Forming a mortgage company in Massachusetts can be fulfilling and profitable. By understanding the industry, forming a solid business foundation, obtaining the necessary licenses, and implementing effective marketing strategies, you can build a successful mortgage company that helps make the dream of homeownership a reality for countless individuals and families in Massachusetts.